Tag: economy

-

A tale of two incentives

Meanwhile, the bullet train has sucked the country’s workforce into Tokyo, rendering an increasingly huge part of the country little more than a bedroom community for the capital. One reason for this is a quirk of Japan’s famously paternalistic corporations: namely, employers pay their workers’ commuting costs. Tax authorities don’t consider it income if it’s…

-

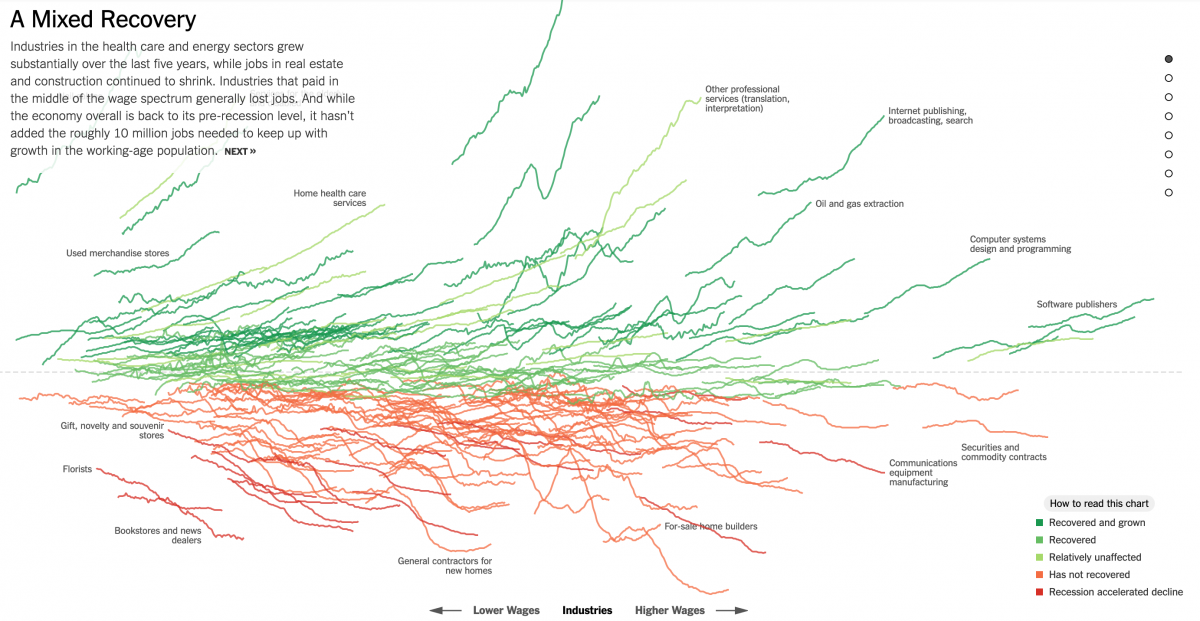

Charting the Digital Revolution

The New York Times data blog, The Upshot has a data-dump piece illustrating the impact of the recession on various sectors of the economy. You can see the full hairball image at the top of the post but what I’ve highlighted is how the digital transformation of publishing has impacted the media business. Up top you…

-

Bay Area Negitive Equity Flood Zones

Another map mashup. This one not as pretty. We just refinanced and collapsed two mortgages into one and locked the whole thing down to a fixed rate mortgage (if you’re looking for a mortgage broker, Anthony Ingoglia is your man) to avoid the 2nd loan adjusting upward upon it’s 10th year anniversary. A lot of…